Platte River Power Authority's 2024 IRP Is A Gaslighting Mess

Platte River Power Authority's 2024 Integrated Resource Plan misleads the public and contains significant omissions, raising concern that WAPA should not approve this flawed plan.

Two or three times per decade, Platte River Power Authority leads a multi-year process to update the utility’s previous Integrated Resource Plan (IRP) before submitting their new plan to the Colorado Public Utilities Commission (PUC) for review. Platte River’s latest 2024 IRP was approved for submission by the PRPA Board of directors, comprised of the mayors of the 4 municipalities and 4 city technical staff, on July 25, 2024. This introductory slide comes from PRPA’s final IRP community presentation held on July 24.

The overriding problem at Platte River Power Authority is the utility’s governance by politicians, the mayors of the 4 member communities, individuals who do not truly possess the competency, skills and professional expertise required to capably manage a major industrial enterprise, the provision of electricity to over 350,000 residents across a wide geographic area. The rule by politicians has pushed PRPA to the edge of absurdity. In 2018, reacting politically to the Trump administration’s 2017 withdrawal from the Paris Climate Accords and grassroots climate activist pressure, the 4 mayors decided to approve a Resource Diversification Policy that energy experts said would most likely be impossible to achieve: 100% carbon-free electricity by 2030 and the total replacement of the utility’s 3 coal-fired power plants by alternative energy sources.

Now 6 years into that scheme, the 2024 Integrated Resource Plan acknowledges that the 100% carbon-free goal can’t be achieved but still leaves fundamental questions unanswered about how that which remains of the resource diversification policy will actually work. However, it does provide a clearer view of the costs. The July 2024 PRPA Board of directors meeting approved an estimated $2.77 billion plan to provide electricity using much more expensive energy sources as the utility ditches coal, including a $250 million investment in building a aero-derivative gas turbine facility. If Platte River's wholesale rate forecast holds up, it will mean 6.3% annual increases in electricity rates for each of the next five years and a 60% increase in the cost of electricity by 2034. This is already dramatically higher than Platte River’s 10-year average wholesale rate forecast reported to the Board in May 2023, which projected increased average wholesale rates of merely 5.0% (2024 – 2030) and 2.5% (2031 – 2033) per year.

The challenge of replacing coal is brought into perspective by a chart included in PRPA’s 2020 Integrated Resource Plan that depicts the utility’s “future energy balance without carbon emitting resources.”

1) The first glaring omission from Platte River’s 2024 Integrated Resource Plan is a chart presenting the planned post-2030 energy balance to meet energy demand. (We happen to know that such a chart exists because one was shown to the public in a 2023 PRPA “community listening session” presentation but, inexplicably, that information is missing from the 2024 IRP.) Platte River now claims that “current modeling” for the 2024 IRP “confirms” that not 100% but 88% noncarbon energy mix is “possible” by 2030 and, they say, “we are confident we will provide 85%+ noncarbon energy in 2030.” But where is the chart demonstrating the most up-to-date planned post-2030 energy balance sufficient to meet demand and why is it not included in the 2024 IRP?

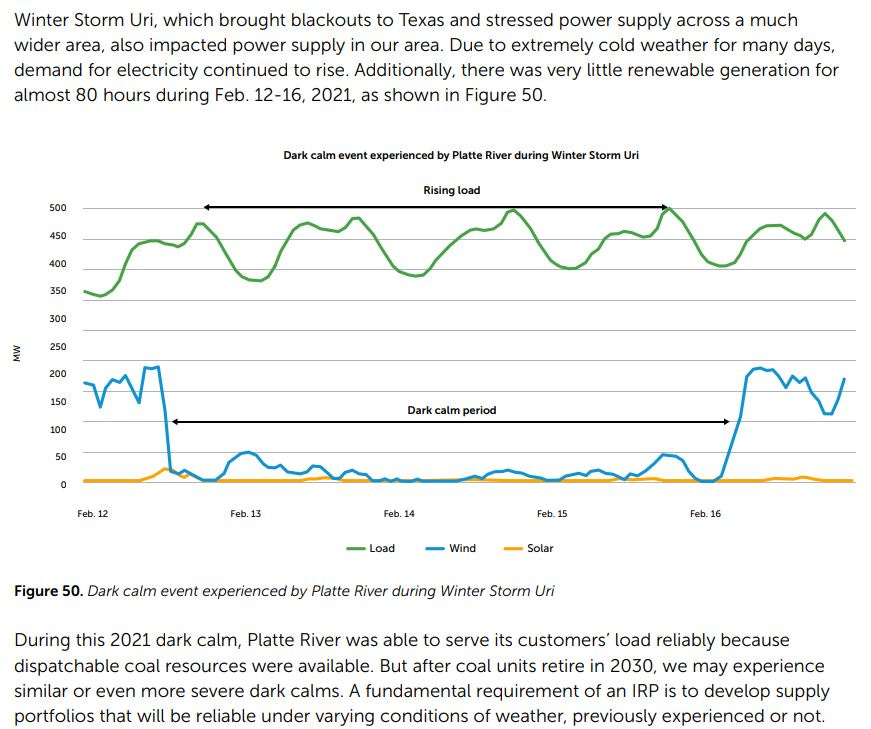

2) The second glaring omission from Platte River’s 2024 Integrated Resource Plan is a documented preparedness plan to address the most predictable high-risk potential for post-2030 energy supply disruption — a “dark calm” winter weather event. “Dark calm” refers to a period of extreme cold combined with low wind and sunlight, resulting in minimal renewable energy generation from wind and solar sources and the possible freezing of gas transmission lines.

In fact, that is exactly what happened in 2021, when Northern Colorado experienced a serious “dark calm” winter event. Platte River acknowledges that the only thing preventing widespread power disruptions at that time was the dispatchable baseload of coal power. An average year sees a total of 248 hours of dark calm spread across events of different durations. The 2024 IRP includes reference to a 2023 independent analysis of extreme weather events and dark calm commissioned by PRPA, but neither that study nor the new IRP provides any explanation whatsoever regarding how exactly we will survive a post-2030 dark calm incident without coal, even though extended dark calms are extremely commonplace events that occur, on average, once every 4 years. Indeed, the 2024 IRP acknowledges that it has a “fundamental requirement” to develop energy supply portfolios that will be reliable under varying weather conditions such as periods of dark calm. Yet it’s missing from the 2024 IRP, an alarming omission.

From page 127 of the 2024 IRP:

How can Platte River rationalize not including contingency planning for dark calm in their 2024 IRP despite recognizing that this is a serious threat and a “fundamental requirement” of an IRP? The consequences of not preparing a post-2030 mitigation plan for dark calm could be severe and contribute to a disaster in several ways, especially in a scenario where building electrification causes increased energy demand and “winter peaking,” which is the spike in electricity demand typically experienced in cold weather:

1. Grid Overload: As temperatures plummet, the demand for energy and electric heating would skyrocket, significantly increasing electricity consumption. If the grid is not adequately prepared for this surge, it could become overloaded, leading to widespread power outages.

2. Insufficient Renewable Energy: During a "dark calm" event, the lack of wind and sunlight would sharply reduce the output from wind turbines and solar panels. This shortfall in renewable energy would mean a heavier reliance on other energy sources, which might not be sufficient to meet the high demand.

3. Inadequate Backup Supply: If the energy grid does not have enough backup power sources, such as coal, it may struggle to supply the necessary electricity during peak demand. This could result in rolling blackouts or prolonged power outages.

4. Heating System Failures: Prolonged power outages could cause electric heating systems to fail, leaving homes and buildings without heat. In extreme cold, this could lead to pipes freezing and bursting, extensive property damage, and severe health risks, particularly for vulnerable populations.

5. Emergency Services Overwhelmed: A widespread power outage during extreme cold could overwhelm emergency services as they respond to heating failures, health emergencies, and infrastructure damage. This could delay assistance to those in critical need and exacerbate the situation.

Platte River’s in-depth analysis of extreme weather events found that a weeklong cold blast occurs about once every 25 years in Colorado. During Winter Sturm Uri in 2021, which lasted only 4 days, natural gas prices skyrocketed due to supply shortfall and transmission bottlenecks. U.S. natural gas demand set a 2-day record high on Feb. 14 and 15, 2021, but natural gas production declined sharply as severe cold temperatures disrupted the operation of industrial equipment. A shortage in natural gas supply occurred due to shut-ins across the western half of the U.S. During the 2021 dark calm, Platte River was able to keep customers’ light on and electric heaters working solely because dispatchable coal power was available.

While summer heat also presents challenges for renewable intermittency, the bottom line planners should be concerned about is that natural gas may not be dispatchable during a dark calm emergency. And even though PRPA admits that the utility “will need similarly reliable supply in the future” to replace dispatchable coal generation during a dark calm event, there is no indication in the 2024 IRP of a plan to ensure the stability of the grid when renewable energy and even natural gas predictably fail during the next major dark calm disruption.

3) Third, serious concerns are being raised by community members about Platte River’s plan for a controversial new natural gas turbine that replaces an older gas setup. The proposed 200-MW replacement of the current gas plant would have turbines that in the future could run on “green hydrogen” instead of natural gas., meaning hydrogen produced by renewable energy sources and stored for burning later. In theory, green hydrogen burns carbon-free, producing water as a byproduct. But in practice, green hydrogen is an unproven technology that could be prohibitively expensive and/or decades away from being scalable to the utility level.

As reported by the Colorado Sun, one of the community voices opposing the gas plant proposal is the Fort Collins Sustainability Group. Kevin Cross, a convener of that group, said opponents don’t want the power authority to commit to a $250 million natural gas plant that consumers would have to pay for in their bills over 30 years, when technology is changing so quickly.

If the cost of building a gas plant proves “to be prohibitively high compared to other options, ratepayers in Fort Collins, Longmont, Loveland and Estes Park could see very high electric bills far into the future,” the group said in an open letter to the Fort Collins City Council, which oversees the city’s partial ownership of Platte River Power Authority. A big, expensive gas plant is likely to become a “stranded asset” in utility parlance, Cross said, meaning an outdated or poorly-designed technology that’s no longer needed but which has loans that ratepayers are stuck with for decades. (The Rawhide and Craig coal plants currently run by PRPA are also set to become stranded assets when they are retired in the next few years, further burdening ratepayers.)

“We think that they’re moving too fast,” Cross said, and instead should avoid issuing an RFP for new gas plant construction until they file a finished resource plan with federal regulators in 2025. “We think they might learn something in the next half year to a year that would make other technologies look more attractive.”

During the Longmont City Council Open Forum on July 30, 2024, community experts Mary Lin, longtime member of the City of Longmont’s Sustainability Advisory Board, and Gary Hodges, a leading expert in surface radiation who works at NOAA Global Monitoring Laboratory, talked about unrealistic expectations regarding hydrogen that are featured prominently in Platte River’s 2024 IRP. (Mary Lin speaks at 54:30 in the video and Gary Hodges speaks at 1:31:30.)

Specifically, Platte River’s 2024 IRP makes seemingly impressive yet wildly optimistic and uncertain statements about hydrogen that may as well have been copied from a science fiction novel, such as these:

"Green hydrogen as a noncarbon-emitting fuel for traditional gas turbines has potential in the future, as technological and economical barriers for storing and transporting hydrogen diminish. Based on the recommendations from Black & Veatch, Platte River assumed a 50% blend of hydrogen with natural gas in 2035 and use of 100% hydrogen in 2040. Future hydrogen pricing is uncertain; IRP modeling assumed 2035 hydrogen prices five times the prices of natural gas by 2035, decreasing to three times of natural gas by 2045.”

"Hydrogen – both green and blue. Green hydrogen is produced by an electrolyzer using renewable electricity, while blue hydrogen is produced from natural gas and the CO2 produced in the process is sequestered and stored in the ground. Hydrogen can be used as fuel in traditional power generation machines like CTs with some modifications…The study concluded that green hydrogen could be a viable option for Platte River starting in the middle of the next decade."

"For dispatchable resources, Platte River relied on the recommendations of Black & Veatch. Platte River decided the best option is to use highly flexible, state-of-the-art, hydrogencapable aeroderivative combustion turbine technology. These machines will initially use natural gas fuel and by 2035 may start using 50% green hydrogen blend and by 2040 may use 100% green hydrogen."

In reality, PRPA knows that there are significant technoeconomic challenges to store and transport hydrogen. These challenges are being downplayed in the 2024 IRP. They include:

Technological Barriers

While green hydrogen holds promise, the technological barriers to its widespread adoption are substantial and not easily overcome within the proposed timeline. Hydrogen's energy density is significantly lower than that of natural gas, necessitating advanced and costly modifications to existing infrastructure and equipment.

The storage and transportation of hydrogen present significant challenges. Hydrogen's low volumetric energy density necessitates high-pressure or cryogenic storage, both of which are expensive and technically complex. Current infrastructure is not designed for hydrogen and would require extensive and costly retrofitting or replacement.

Hydrogen embrittlement, which weakens metal and other materials, poses a significant risk to the integrity of pipelines and storage facilities. Addressing these issues requires substantial research and development, which may not progress at the required pace.

The assumption that these barriers will diminish sufficiently by the middle of the next decade is speculative. Current trends and technological advancements suggest a much longer timeline is more realistic.

The development and deployment of hydrogen-capable aeroderivative combustion turbines involve complex engineering challenges. While some prototypes and small-scale implementations exist, scaling up to a utility level within the proposed timeframe is ambitious and may not be feasible.

The integration of such technology requires not only advancements in turbine design but also in hydrogen production, storage, and distribution infrastructure, all of which must be developed concurrently.

Economic Barriers:

The economic feasibility of green hydrogen remains highly uncertain. The assumption that hydrogen prices will be five times that of natural gas by 2035, decreasing to three times by 2045, does not account for the volatility and unpredictability of the energy markets.

The cost of producing green hydrogen via electrolysis is currently prohibitive, primarily due to the high electricity consumption required. Even with advancements in renewable energy, the cost reductions needed to make green hydrogen competitive with natural gas are ambitious and uncertain.

Blue hydrogen relies on carbon capture and storage (CCS) technologies, which are still not widely implemented at scale due to technical, economic, and regulatory hurdles. The effectiveness and reliability of long-term CO2 storage remain contentious issues.

Assuming blue hydrogen as a transitional solution until green hydrogen becomes viable may overlook these significant challenges, making the transition timeline overly optimistic.

The economic viability of transitioning from natural gas to a 50% hydrogen blend by 2035 and 100% by 2040 is questionable. The cost of retrofitting or replacing existing turbines, combined with the high cost of hydrogen production, poses significant financial risks.

The assumed decrease in hydrogen prices over time does not adequately consider the capital investment required for developing and maintaining the necessary infrastructure, which could negate expected cost reductions.

In summary, the transition plan assumes a smooth and timely development of hydrogen technologies, which is highly uncertain. Delays or setbacks in hydrogen technology advancements could leave PRPA reliant on natural gas for much longer than anticipated, undermining decarbonization goals. The conversion of existing natural gas infrastructure to accommodate hydrogen is not straightforward. It involves significant technical challenges and safety concerns, which may not be resolved within the proposed timeframe.

Furthermore, the future availability and pricing of green hydrogen are speculative. Energy markets are highly dynamic, and predicting the economic viability of hydrogen in comparison to natural gas several decades into the future involves substantial uncertainty. Relying on future technological breakthroughs and market conditions for current decision-making introduces a high level of risk.

Therefore, the claims regarding the future use of green hydrogen by PRPA, as recommended by Black & Veatch, are overly optimistic and filled with uncertainties. The technological, economic, and infrastructural challenges associated with the widespread adoption of hydrogen as a fuel are significant and likely to persist for the foreseeable future. While the vision of a hydrogen-based energy system is seductive, realistic assessments must consider the substantial hurdles that remain. A more balanced and cautious approach, acknowledging these challenges and uncertainties, would be more prudent for future energy planning.

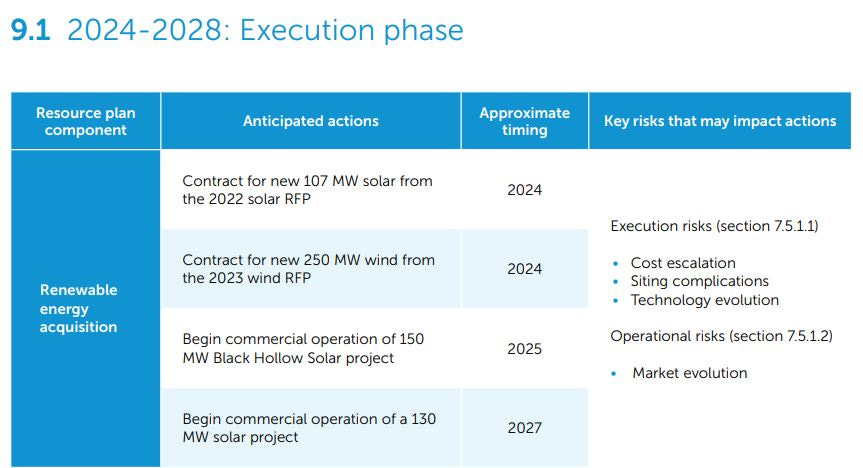

4) Fourth, Platte River’s 2024 IRP relies heavily on massive expansion of industrial-scale centralized solar and wind power generation coming online in the next 2 to 6 years to fill the gap created by the imminent shutdown of the Rawhide and Craig coal-fired power plants.

As a matter of introductory overview, the 2024 IRP analyzes five different hypothetical energy portfolios that cover “a wide range of future paths.” The IRP concludes, “The optimal new carbon portfolio builds 200 MW of new efficient thermal generation and presents a viable path. This portfolio presents a balance between the additional new carbon and carbon-imposed cost portfolios in both cost and the amount of new thermal generation. This portfolio better supports reliability if weather events continue to become more extreme, as they have in the recent past. This is our recommended portfolio.”

However, the optimal new carbon portfolio recommendation comes with the stunning caveat that this is merely “a possible path for the future” and “not a firm plan”:

Nevertheless, in July 2024, ground broke on northern Colorado’s largest solar generation project to date, Black Hollow Solar, which spans nearly 1,400 acres northeast of the Black Hollow Reservoir near Severance in Weld County, Colorado. The first phase of the project is expected to be completed by May of 2025 and will deliver about 367,000 MWh of energy annually to Platte River’s owner communities of Estes Park, Fort Collins, Longmont, and Loveland. Phase two of Black Hollow Solar will add an additional 107 MW of capacity in 2026, bringing the total project to 257 MW and increasing Platte River’s total solar capacity to 309 MW.

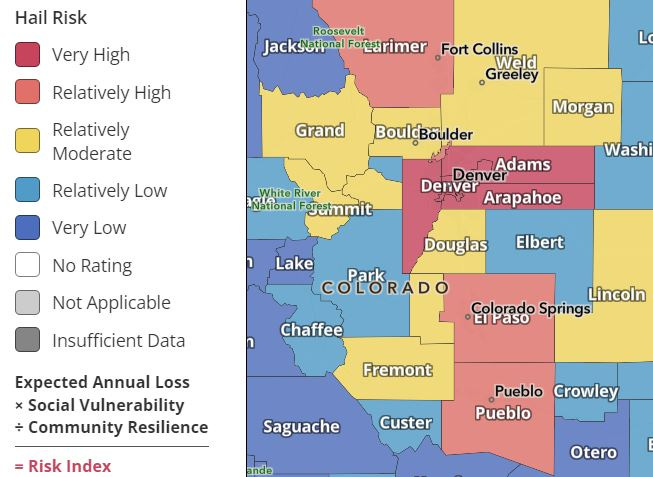

Unfortunately, the problem with this massive solar installation is its location directly inside “Hail Alley,” just 40 miles due south of “hail capital” Cheyenne, Wyoming. Hail is the worst enemy of solar panels, and Colorado averages $1,987.64 per 100 residents in annual property damage from hail, the second highest in the United States behind Texas.

Economically damaging hail is commonplace in Weld County. In June 2024, Weld County commissioners approved a disaster declaration for a massive hailstorm that struck the region on May 28, causing around $3.4 million in damages to hundreds of structures and public infrastructure. Another $1.5 million in damages from the same hailstorm was done inside the city of Greeley, located just 20 miles from PRPA’s 1400-acre Black Hollow Solar project

It’s no secret what can happen when a bad hailstorm crosses its path with a large solar installation. We have only to look at the March 2024 hailstorm near Damon, Texas that devastated the Fighting Jays Solar Farm. This solar project, which began producing power for Texas's energy grid in 2022, generated 350 megawatts across 3,300 acres of land and was expected to power 62,000 homes, until a powerful hailstorm with baseball-sized hail stones damaged thousands of acres of solar panels and created a toxic mess. While the solar farm was not completely destroyed, GridInfo.com shows that the power output decreased by about 50% after the hailstorm. A 2021 report credited to insurer GCube found that 70% of solar losses from extreme weather in the 10 years occurred since 2017. Climate change is likely to fuel more severe and more frequent hailstorms, according to a white paper from PV Evolution Labs, an independent research organization for the solar industry.

As reported by the Institute for Energy Research, “Last year, GCube Insurance, an underwriter for renewable energy, released a report stating that the solar industry needs to find low-cost solutions due to the escalating frequency and severity of hailstorms, based on data it collected over five years. It reported that hail claims average around $58.4 million per claim and account for 54.21 percent of incurred costs of total solar loss claims being attributable to hail, which creates a gap between the insurance requirements for solar projects and what is available in the market, leading to project delays and cancellations. The report identifies several factors contributing to solar project vulnerability, including inadequate hail risk models, ineffective mitigation strategies, limited and costly insurance coverage, and an uncertain funding landscape. It also highlights how solar manufacturers wanting to reduce costs have introduced larger solar panels with thinner, more fragile glass and have chosen locations more susceptible to hail risk, threatening the financial viability of future projects.”

According to the Weld County government, “a 2024 report by Roof Gnome shows Colorado remains one of the most hail-prone states in the U.S. with three counties ranking in the top-10 as being most at risk for hail damage.” Weld County, where PRPA’s massive Black Hollow Solar farm will be located, ranked in the top 10% of U.S. counties most at risk of hail damage, and the Federal Emergency Management Agency (FEMA) National Risk Index Study (see map below) showed the county's risk index as “relatively moderate.” Roof Gnome ranks Weld County 127th worst for incidence risk of hail damage and 119th worst for financial risk of hail damage out of the USA’s 3,000+ counties.

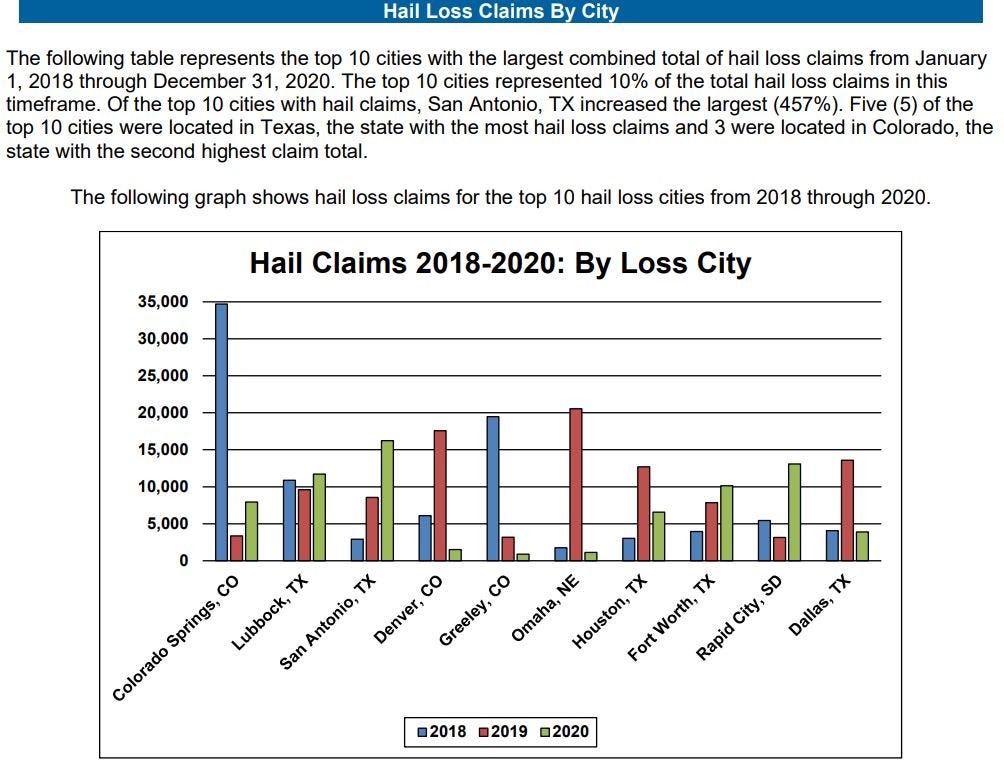

Colorado ranks 2nd in the U.S. for hail insurance claims. However, Roof Gnome’s study may downplay the hail risk to Weld County because other counties (such as Denver) contain a much higher concentration of financially valuable and densely zoned property. Weld County is frequently cited as one of the most hail-prone counties in the U.S. due to its location within "Hail Alley," which receives the highest frequency of large hail in North America. Colorado residents usually can count on three or four catastrophic (defined as at least $25 million in insured damage) hailstorms every year. In the last 10 years, hailstorms have caused more than $5 billion in insured damage in Colorado. According to a March 2021 NICB Hail Report, Weld County’s largest city, Greeley, was the city with the 5th most hail claims in the entire country — almost as bad as Denver with a fraction of the population.

Rocky Mountain Insurance Information Association and weather analytics firms have noted that Weld County experiences more hail events annually than almost any other region in the country. Additionally, the National Oceanic and Atmospheric Administration (NOAA) tracks hail events and consistently identifies Weld County as being particularly vulnerable, a designation that is based on the frequency, size, and severity of hailstorms recorded over time. Is it really wise to make ourselves dependent on expensive solar energy infrastructure that can be rendered permanently useless by a single bout of violent weather? Amazingly, Platte River’s 2024 IRP contains no analysis or mitigation plan relative to the risk of catastrophic hail damage relative to the 387 MW of new industrial-scale solar farms PRPA says they are going to “execute” in the next 3 years. From page 176 of the IRP:

Finally, we are being told that the 2024 IRP represents a plan to reduce fossil fuel emissions for climate action. But by replacing existing fossil fuel with new fossil fuel, PRPA would be committing itself to another CO2 emitting resource for the long-term. Independent analysis recommends the proper comparison of lifecycle greenhouse gas (“GHG”) emission impacts is to compare the emissions from a new gas-fired plant over its expected 40-year life with the emissions from the existing Rawhide plant through the end of its useful life in 2047, followed by new renewable power with battery storage.

Independent analysis conducted several years ago by the consulting firm Energy Ventures Analysis, on behalf of the Fort Collins Chamber of Commerce, concluded that operating the Rawhide coal plant until the end of 2047 would yield almost 2 million tons of CO2e emissions less than replacing it with a new gas plant in 2030. “Allowing more time for renewable energy plus storage to become more economically feasible to replace baseload or intermediate resources by continuing to operate the Rawhide Energy Station past 2030 will result in higher GHG emission reductions than replacing existing fossil fuel generation with new fossil fuel and CO2-emitting generation,” the study concluded.

In conclusion, the 2024 Integrated Resource Plan (IRP) presented by Platte River Power Authority (PRPA) is fraught with significant challenges and omissions that undermine its credibility and viability. The governance structure that places decision-making power in the hands of politicians, rather than energy experts, has led to a plan driven by political motivations rather than sound technical and economic analysis. The ambitious goal of achieving 100% carbon-free electricity by 2030 is revealed to be unrealistic and comes with a projected $2.77 billion price tag that will significantly burden ratepayers just to reach the much more modest goal of 85% carbon-free electricity.

Moreover, the 2024 IRP fails to provide crucial details and contingency plans, particularly concerning the "dark calm" winter weather events that pose a high risk to renewable energy generation and the potential for catastrophic hail damage to solar farms. The lack of a documented plan to address these predictable high-risk scenarios is a glaring omission that raises serious concerns about the reliability of the future energy supply.

The controversial proposal to invest $250 million in a new natural gas turbine facility, with the assumption that it will eventually run on green hydrogen, is another major flaw. This technology is unproven and potentially prohibitively expensive, and the plan to rely on it introduces significant financial risks for ratepayers. The optimistic projections about the future viability and affordability of green hydrogen are speculative at best and ignore substantial technological and economic barriers.

Community concerns and expert opinions have highlighted the unrealistic expectations and lack of transparency in PRPA's 2024 IRP. The independent analysis indicating that continuing to operate the Rawhide coal plant until 2047 would result in lower overall CO2 emissions further undermines the rationale behind the current plan.

Given these substantial issues, the 2024 IRP represents a gaslighting mess that obscures the true challenges and risks associated with PRPA's proposed energy transition. It is imperative that the Western Area Power Administration (WAPA) should carefully review this plan and consider sending it back to PRPA for thorough revision. This revision should incorporate more community input and comprehensive market research to develop a realistic and reliable path forward. Only through a transparent and well-considered approach can PRPA truly achieve its goals of reducing fossil fuel emissions while ensuring a stable and affordable energy supply for its constituents.

I encourage other citizens to review the 2024 Integrated Resource Plan, reach your own conclusions, and share your thoughts in the comments below.

Ethan Augreen holds a MA degree in Environmental Leadership from Naropa University and currently serves on the Sustainability Advisory Board in Longmont, Colorado.

Brilliant work, Ethan. Bottom line: this hellish agenda pits environmentalists against farmers and . . . environmentalists.

Readers: do whatever you can to stop this.

Fantastic article, Ethan! You bring to light important points I was previously unaware of. What we see taking place is aspirational policy making at its worst. It is clear our local leaders need to set aside dreams, hopes, and egos, and pause the current path we are on until we can be confident of future technologies. At a PRPA presentation to city council about one year ago the presenter stated only the most optimistic projections were being shown. Making policy decisions based on unbridled optimism is a bad idea that will lead to poor outcomes. Sadly, those most negatively affected are at the lower end of the economic spectrum. We are already seeing the beginning of this with council voting during the 07/23/2024 meeting (https://youtu.be/qKlBK05PuT4?t=3901) to divert funding intended to foster economic growth to instead assist residents having difficulty paying their utility bills.