Open Letter to Longmont City Councilmembers regarding PRPA's 2024 IRP

The following letter was discussed by Longmont’s Sustainability Advisory Board on October 16, 2024. While the letter was not approved for submission to City Council by a majority of Board members, Longmont City Councilmembers would surely benefit from reading it.

Dear City Councilmembers of Longmont,

The Sustainability Advisory Board (SAB) appreciates Platte River Power Authority (PRPA) presenting their 2024 Integrated Resource Plan (IRP) to the Board on August 21, 2024 as well as the considerable effort and analysis that PRPA staff put into creating this IRP.

While the 2024 IRP provides valuable insight into the major challenges our region faces to achieve policymakers’ expressed goal of 100% carbon-free electricity by 2030 (or beyond), the SAB is deeply concerned about potentially serious shortcomings in the analysis within this IRP and the proposed direction of PRPA’s resource diversification. As we will outline in more detail, the plan could put at risk the sustainability, reliability and affordability of future energy supply for Longmont citizens, residents, and businesses.

Reliability, financial sustainability and environmental responsibility are the three foundational pillars of PRPA’s service to the communities of Northern Colorado. The soundness of each of these pillars is made questionable in light of the “Optimal New Carbon” portfolio recommended by the 2024 IRP, which envisions replacing coal with a new gas plant and renewable energy. Please see below an overview of our concerns related to each foundational pillar, followed by a series of specific concerns and recommendations with respect to the content and process of the IRP.

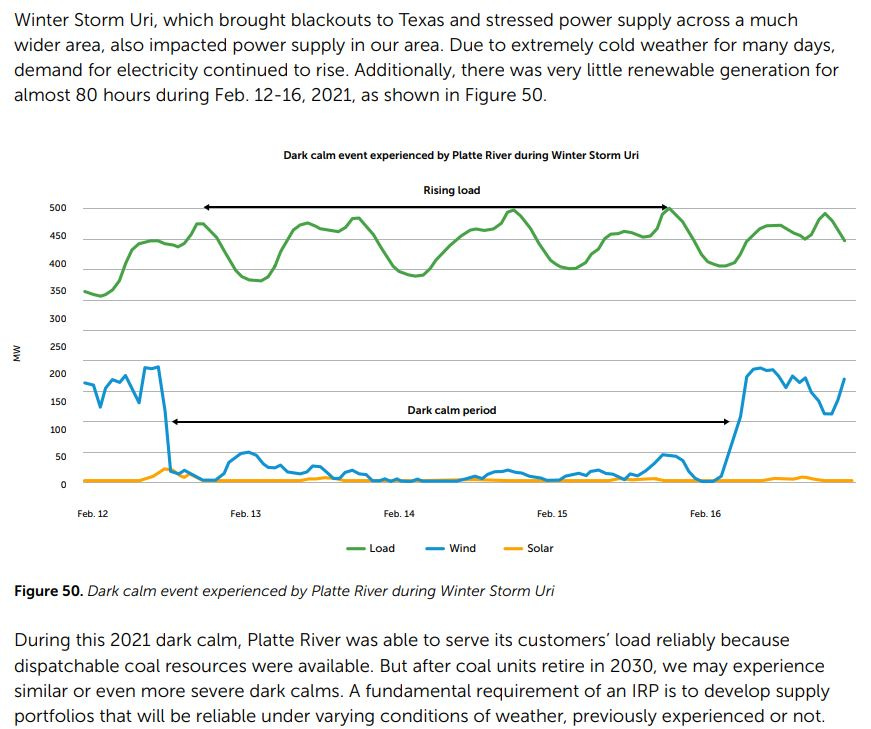

Reliability: While the climate and air pollution arguments against coal are compelling, we must recognize the reality that replacing coal with natural gas and intermittent renewable wind and solar power is likely to decrease the reliability of the energy grid. This is particularly concerning in relation to a “dark calm” event such as the Winter Storm Uri of 2021, when PRPA would have experienced blackouts if not for the availability of dispatchable coal generation. It remains unclear how PRPA would maintain reliability during a similar—or worse—future “dark calm” event without coal. Moreover, PRPA’s planned capacity reduction of hydrocarbon generation to under 600 MW, with a majority reserved for peak use, raises concerns. With Longmont’s peak demand reaching 680 MW in 2023, the potential energy gap during extended periods of low renewable output becomes apparent.

Financial Sustainability: The planned construction of a new 200 MW CCGT gas plant comes with a steep price tag on top of the cost of renewable energy having already grown exponentially since 2020 due to increased demand, supply constraints, and general inflation. PRPA’s projected 6.3% annual increase in electricity rates for each of the next five years and a 60% increase in the cost of electricity by 2034 is a substantial burden for ratepayers to bear that would significantly impact low-income households. Furthermore, the ONC portfolio relies heavily on natural gas to meet demand during times when renewable energy is not available. As shown during Winter Storm Uri, natural gas prices can be highly volatile in extreme conditions, skyrocketing astronomically, which is a risk that coal is not readily subject to. Without sufficient financial risk mitigation, the ONC portfolio exposes PRPA and its member communities to potential price shocks, in addition to the much higher costs already baked into the planned construction of a new gas plant and large-scale build-out of renewable energy and battery storage.

Environmental Responsibility: The ONC portfolio raises concerns regarding environmental issues due to its increased dependence on natural gas, likely derived from hydraulic fracturing (fracking). Fracking has significant environmental impacts that should be fully considered in the context of PRPA's energy transition strategy. One of the most dangerous impacts of increased reliance on fracked gas is the contamination of water resources. Chemicals used in fracking fluids can leach into nearby groundwater sources, potentially compromising the safety of drinking water for local communities. In addition, fracking is associated with increased greenhouse gas emissions, particularly methane, a potent greenhouse gas. Fracking operations release volatile organic compounds (VOCs), particulate matter, and other air pollutants that contribute to smog formation and respiratory health problems. Fracking also has significant implications for land use and ecosystem integrity, requiring extensive land clearing for drilling pads, pipelines, and access roads, leading to habitat destruction and fragmentation. Moreover, the ONC portfolio’s focus on building new natural gas infrastructure locks PRPA into a dependence on fossil fuels for years to come, potentially delaying the transition to cleaner, renewable sources of energy. This reliance may result in higher long-term carbon emissions, especially if the speculative hydrogen conversion of gas turbines proves to be technologically and economically unfeasible.

As advocates for Longmont's sustainable future, we feel it is imperative to bring to City Council’s attention several specific concerns with PRPA’s 2024 IRP that we believe should be addressed to ensure the reliability, affordability and sustainability of our community's energy supply.

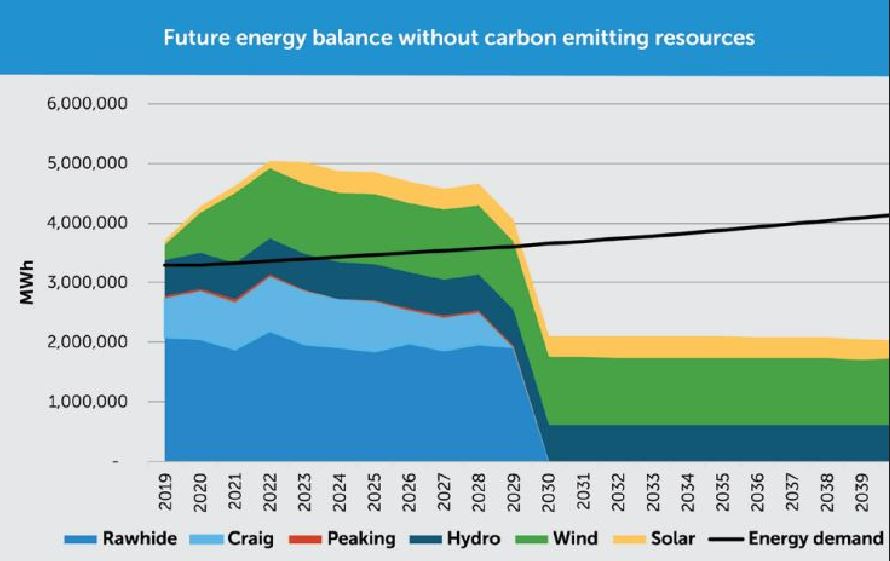

1. Omission of data/charts displaying post-2030 energy balance sufficient to meet energy demand.

Recommendation: PRPA should incorporate detailed post-2030 energy balance charts showing how supply will reliably meet demand. The charts should include modeling for post-2030 energy balance during periods of low renewable generation at daily, weekly, monthly and seasonal intervals of time.

Context: PRPA’s 2020 IRP did include several charts showing future energy balance without carbon emitting resources insufficient to meet energy demand, including the chart copied below. We think it’s important for PRPA to model and demonstrate to the public, policymakers and regulators how the energy portfolios evaluated in the 2024 IRP perform in terms of meeting energy demand, especially the recommended Optimal New Carbon portfolio.

2. Need to address “fundamental requirement” of planning to manage "Dark Calm" events.

Recommendation: PRPA should include a detailed plan for managing “Dark Calm” scenarios, including potential backup generation or storage solutions, to ensure system resilience during prolonged renewable energy droughts.

Context: The text accompanying Figure 50 (see below) of the 2024 IRP acknowledges that “During the 2021 dark calm, Platte River was able to serve its customers’ load reliably because dispatchable coal resources were available. But after coal units retire in 2030, we may experience similar or even more severe dark calms. A fundamental requirement of an IRP is to develop supply portfolios that will be reliable under varying conditions of weather, previously experienced or not.”

Nevertheless, the 2024 IRP fails to validate and explicitly plan for how PRPA will handle a dark calm event without dispatchable coal, a significant omission. Given PRPA says this is a fundamental requirement, this omission appears to be a concerning admission that future grid reliability is not secure.

3. Absence of plans to mitigate and prevent destruction of solar farms by hail damage.

Recommendation: PRPA should include analysis of hail risk and planning for implementation of industry-leading best practices, such as advanced protective coatings or hail-resistant panel designs, to prevent hail damage to solar farms, minimizing both financial risk and downtime.

Context: Weld County is part of “Hail Alley” and one of the most hail-prone regions in the United States. Large-scale solar farms, like the one PRPA is installing in Weld County, are uniquely vulnerable to hail damage. A catastrophic hail storm could not only risk our region’s reliable energy supply but also subject PRPA to a large financial loss if solar panels need to be repaired or replaced. In recent years, Weld County has faced severe hail storms causing millions of dollars in property damage. The predictability of this weather-related risk seems to cast into doubt the wisdom of PRPA’s resource diversification strategy of locating a large portion of future energy supply in the heart of Hail Alley.

4. Concern about the estimation of hydrogen energy projections presented in the IRP, with need for attention to issues of technological and economic constraints facing utility-scale development of hydrogen, and the need for additional independent evaluation of PRPA’s hydrogen forecasts by neutral, 3rd-party subject matter experts.

Recommendation: In addition to the Black & Veatch study PRPA contracted, additional independent expert review should be conducted to ensure that the technological and economic challenges are fully considered. This would provide greater confidence in the feasibility of hydrogen as a future fuel source.

Context: At the present time, hydrogen is a speculative technology and not deemed to be commercially viable at the utility scale. Delays or setbacks in hydrogen technology advancements could leave PRPA reliant on natural gas for much longer than anticipated, undermining decarbonization goals. The conversion of existing natural gas infrastructure to accommodate hydrogen involves significant technical challenges and safety concerns, which may not be resolved within the proposed timeframe. Therefore, the claims regarding the future use of hydrogen by PRPA appear to be overly optimistic and filled with uncertainties. The technological, economic, and infrastructural challenges associated with the widespread adoption of hydrogen as a fuel are significant and likely to persist for the foreseeable future. While the vision of a hydrogen-based energy system is seductive, realistic assessments must consider the substantial hurdles that remain. A more balanced and cautious approach, acknowledging these challenges and uncertainties, would be more prudent for future energy planning.

5. Concern regarding financial sustainability of the IRP’s recommended “Optimal New Carbon” portfolio, including cost overruns, the exponentially rising price of renewable energy since 2020, and affordability for ratepayers.

Recommendation: PRPA should provide a more granular financial analysis, including sensitivity scenarios for cost overruns and escalating renewable prices, to better understand and mitigate the potential rate impacts on average ratepayers.

Context: Figure 3 in PRPA’s 2024 IRP (see below) shows how the prices for wind and solar energy have doubled since 2020. While it’s impossible to know if this trend will continue into the foreseeable future, we do know that Coloradans have suffered from rising costs across the board in recent years, including food, rent, insurance, property tax, and interest rates, as well as energy. Given the general impact of inflation in today’s economy, it is worrisome that electricity rates could rise even higher than the 6.3% annual increase for each of the next five years and a 60% increase in the cost of electricity by 2034 that PRPA is currently projecting. Our local and regional economy has thrived on relatively cheap energy and the increasing cost of energy set into motion by the 2024 IRP is likely to have significant economic reverberations. The significant cost increase calls into question whether PRPA has fulfilled the requirement for “designated ‘least-cost options’ to be utilized by the customer for the purpose of providing reliable electric service to its retail consumers,” which is one of the criteria for approval of the IRP.

6. Concern about public participation from the Longmont community in the IRP development process, and request for PRPA to hold at least one more Community Listening Session in Longmont at a time that does not conflict with other major events.

Recommendation: PRPA should schedule at least one additional community listening session in Longmont at a more accessible time and venue, ensuring that key stakeholders and residents have a fair and equal opportunity to provide input on the IRP.

Context: One of the requirements for approval of the IRP is that the utility has “in preparation and development of the plan (and each revision or amendment of the plan) has provided for full public participation, including participation by governing boards.” However, in the course of developing the 2024 IRP, only one community listening session was held by PRPA in Longmont on November 13, 2023. Unfortunately, that community listening session was poorly attended and it occurred at the same time the Denver Broncos were playing a Monday night football game, which may have been a factor contributing to the low attendance. Ideally, PRPA would convene a robust forum in Longmont for community members to provide feedback on the IRP process and incorporate the input received into the IRP in order to comply with the requirement for full public participation before the IRP is submitted for approval.

7. Concern about the uncertainty of energy markets resulting from the 2024 election.

Recommendation: PRPA should delay the submission of the IRP until 2025 to account for possible post-election policy changes.

Context: PRPA is required to submit a new IRP every 5 years and the current IRP update is not due until 2025. Submitting the IRP one year early in 2024 provides little benefit but precludes PRPA from factoring into the IRP the results from the 2024 election. It’s evident that U.S. federal government policy could change dramatically due to the 2024 election results, as it has in the past. Given the potential for significant policy shifts after the 2024 election, delaying the IRP submission until 2025 would be prudent and allow PRPA to incorporate any changes, resulting in a more informed and adaptable plan.

8. Concern about possible over-reliance on optimistic load growth assumptions.

Recommendation: PRPA should include more detailed sensitivity analysis for different scenarios of high load growth due to widespread adoption of electrification, electric vehicles, heat pumps, artificial intelligence, and other technologies. This would ensure that PRPA’s grid planning is adaptable to a range of future demand conditions.

Context: The IRP may assume relatively stable or moderate load growth projections without fully accounting for potential shifts in electrification, electric vehicle adoption, and other factors that could significantly increase electricity demand. Electrification of transportation and heating, in particular, could drive up load growth in ways that exceed current projections.

9. Concern that the IRP does not consider all practicable energy portfolios.

Recommendation: PRPA should expand the scope of its IRP to include a thorough evaluation of all viable energy portfolios. For example, one hypothesis not considered in the 2024 IRP is the possibility of running the Rawhide coal plant at “minimum load,” which is the lowest possible stable operational output, as a major step toward decarbonization. The strategy of minimum load would allow the plant to remain online as a baseload dispatchable power source while significantly reducing coal consumption and emissions. This hypothetical approach can be called the "Optimal Cost-Efficient Decarbonization" (OCED) portfolio, and it could theoretically provide a more balanced and cost-effective transition than the “Optimal New Carbon” portfolio. PRPA should conduct a comprehensive evaluation of the OCED hypothesis, alongside the current options in the IRP, as well as consult with independent experts to assess whether any other practicable energy portfolios are missing from the IRP.

Context: The first condition for approval of the IRP is that the plan must have “identified and accurately compared all practicable energy efficiency and energy supply resource options available” to the utility. During the course of PRPA’s presentation to SAB on August 21, it became clear that PRPA has experienced success recently in terms of operating the 280 MW Rawhide coal plant at minimum load as low as 80 MW. One of the PRPA employees who provided testimony to SAB stated (to slightly paraphrase his comments), “Since we've entered into the regional power market a year ago we've been teaching ourselves to work dynamically with the market, including adding more flexibility to our Rawhide coal unit one so that one way they're able to respond to the signals of the market is we've actually been able to get Rawhide Unit One to run at the lowest of 80 megawatts. You don't hear of a coal unit running below 100 megawatts because you risk functionality and maintenance vulnerabilities but we've been able to make some modifications to our unit to achieve this flexibility.”

While PRPA is under a federal mandate to retire Rawhide by the end of 2029, keeping Rawhide operational at minimum load could be as simple as applying for a waiver. If a minimum load strategy for Rawhide is combined with ending PRPA’s use of the Craig coal units, participation in regional transmission organizations, the renewable energy expansion already planned, and other complementary measures, then PRPA could conceivably still achieve compliance with Senate Bill 19-236, which requires utilities to reduce carbon dioxide emissions 80% from 2005 levels by 2030.

To be clear, we are not advocating for adoption of a minimum load strategy by PRPA but rather stating simply that this seems to be a promising idea that is worthy of inclusion and serious evaluation in the IRP as a potentially viable energy portfolio.

Key Points of the OCED Hypothesis:

Reliability: Running coal plants at minimum load ensures grid stability and reduces risk of brownouts or blackouts during periods of dark calm while integrating greater supply of intermittent renewable resources.

Cost Efficiency: By avoiding the construction of costly new gas-fired generation and leveraging existing infrastructure, the OCED plan minimizes capital expenditure, reduces the financial cost of stranded assets, and aligns with long-term financial sustainability goals.

Environmental Responsibility: While more study is needed, the OCED hypothesis can potentially achieve PRPA’s emissions reduction targets by using existing coal capacity more efficiently, avoiding dependence on new carbon resources, and preventing intensification of the environmental impacts of fracking, at the same time as accelerating renewable energy deployment and leveraging carbon credits and offsets through innovative programs like tree planting and regenerative agriculture.

Given that the 2024 IRP is being submitted one year early, PRPA could easily withdraw the 2024 IRP and extend the review period by 6 to 12 months to address our concerns thoroughly. We request the Board of directors of PRPA consider ordering the withdrawal of this IRP and directing staff to strengthen the IRP and address these concerns and recommendations.

In summary, as discussed above, we are concerned that PRPA has chosen to present their most optimistic projections as a basis for decision-making. As admitted during their fall 2023 presentation to Longmont City Council, this approach introduces significant risk to long-term planning. Relying on the most favorable scenarios, without adequately considering worst-case conditions, brings into question the IRP and fails to protect the community from potential energy shortages. By framing their planning on best-case scenarios, PRPA is ignoring the significant uncertainties in energy generation, especially during critical "dark calm" events when renewable sources like wind and solar are unavailable, and does not address the real possibility that actual conditions could be much worse than the forecasts suggest.

At a time when Longmont’s peak demand has already reached 680 MW (as of 2023), PRPA’s plan to reduce hydrocarbon generation capacity to 588 MW (more than half of which is not in regular use and reserved for peaking) seems ill-prepared for future growth and increasing demand. Relying on natural gas to cover 100% of demand during critical periods is not a sustainable strategy, especially when renewable generation is projected to fall short during periods of dark calm.

PRPA's justification for the ONC portfolio—that the new gas turbines can eventually be converted to run on hydrogen—also raises concerns. Hydrogen is currently far from being a scalable solution for utility-level power generation. Industry experts estimate that grid-scale hydrogen production may not be feasible until at least 2050. Additionally, key technologies and infrastructure required for hydrogen production, storage, and transport are still largely underdeveloped. Even PRPA's own engineers admitted during their presentation to the Sustainability Advisory Board that they do not yet fully understand how the hydrogen transition would work in practice

Despite these uncertainties, PRPA is moving ahead with plans to phase out natural gas access for residential and commercial customers, effectively forcing electrification and placing the burden of retrofitting costs on Longmont residents. The premature and forced electrification of homes and businesses without adequate infrastructure and energy supply reliability is deeply concerning.

While electrification is a long-term goal, the rapid pace at which PRPA is seeking to phase out natural gas access could result in significant financial burdens for residents and businesses. Retrofitting homes to accommodate all-electric systems often requires costly upgrades to appliances, electrical panels, and insulation. Forcing such changes now, without providing sufficient financial assistance or ensuring that the electric grid can reliably support this increased demand during "dark calm" periods, could lead to inefficiencies and higher overall energy costs for consumers.

Moreover, forced electrification could reduce system efficiency. Natural gas, despite being a fossil fuel, is currently a highly efficient heating source for homes, particularly in cold climates. Moving to electric heating, while it may reduce direct emissions, often results in higher energy use overall due to the inefficiencies of electric resistance heating, unless advanced technologies like heat pumps are universally adopted. These efficiency losses would offset some of the gains from reducing CO2 emissions.

PRPA should take a more gradual approach to electrification, ensuring that grid reliability and the necessary infrastructure are in place before forcing widespread electrification. A more detailed cost-benefit analysis of electrification should be conducted, including the costs to ratepayers and the potential efficiency losses during periods of high electricity demand.

In conclusion, the Sustainability Advisory Board urges the Longmont City Council to critically evaluate PRPA’s 2024 IRP in light of these significant risks. We urge PRPA to voluntarily withdraw its current IRP submission and take the necessary time to develop a more balanced and realistic plan—one that does not rely on speculative technologies and overly optimistic projections.

The future reliability and affordability of Longmont’s energy supply depend on PRPA taking a more cautious and thoughtful approach, ensuring that all viable alternatives, including the OCED hypothesis, are fully evaluated. A comprehensive, realistic IRP is essential to ensure that Longmont continues to meet its energy needs in a way that is financially affordable, environmentally responsible, and resilient to future challenges.

===============================

Appendix A – Darm Calm Scenario

We wish to highlight in particular the safety and financial risk that can result from the case of a Winter Storm Uri-like event in which PRPA has retired all coal capacity but has a new 200 MW CCGT gas plant. The following key issues could arise:

1) Natural Gas Supply Disruption

During Winter Storm Uri in 2021, natural gas supplies were significantly disrupted across the Midwest and Texas due to freezing pipelines and wellheads. This led to both physical shortages of gas and massive price spikes, with natural gas prices skyrocketing from normal levels of $2-3/MMBtu to as much as $1,000/MMBtu. If PRPA were relying solely on the 200 MW CCGT gas plant during such an event, there would be a serious risk of:

Fuel Shortages: PRPA might face reduced or interrupted gas supplies, forcing the plant to operate at reduced capacity or even shut down. This would critically impact PRPA’s ability to meet demand during an extreme cold event, particularly if renewable generation is also low.

Cost Spikes: Even if gas were available, the price would likely increase dramatically. As a result, the cost of electricity generation from the CCGT plant could surge, leading to extremely high electricity prices for consumers.

2) Reduced Renewable Output

In "dark calm" scenarios like Winter Storm Uri, renewable energy sources (wind and solar) tend to perform poorly. During the event, wind turbines across Texas froze and wind generation dropped significantly, while heavy cloud cover and short winter days reduced solar output. In PRPA’s case, this could mean:

Near-zero Renewable Output: PRPA would have to rely almost entirely on dispatchable resources (the CCGT plant and potentially energy storage) to meet electricity demand. With the gas plant facing supply and price challenges, this would put immense pressure on PRPA’s grid reliability.

3) Potential Blackouts

If the 200 MW CCGT gas plant is unable to operate at full capacity due to gas shortages, PRPA would likely face significant shortfalls in its ability to meet demand. Under such conditions, there would be an increased likelihood of rolling blackouts or extended outages. The scale of this impact would depend on:

Demand Levels: Winter storms typically cause electricity demand to spike due to heating needs, particularly in electric-heated homes. If deman d exceeds the available generation capacity, PRPA would have no choice but to shed load (through blackouts) to protect grid stability.

Energy Storage: The extent of energy storage available could mitigate some impacts, but storage is typically limited in duration (e.g., 4-8 hours), meaning it would not provide long-term coverage for multi-day events like Winter Storm Uri.

4) Extreme Cost to Ratepayers

Even if PRPA could manage to keep the 200 MW CCGT plant running through the event, the high cost of natural gas would result in extreme electricity prices for consumers. Texas saw wholesale prices of electricity rise to $9,000 per MWh during the storm, leading to massive financial burdens for customers. In PRPA’s case, the combination of supply shortages and high demand could similarly drive up prices, resulting in a significant economic impact on ratepayers.